Portfolio Performance of the Investment Portfolios

This page displays all of the investment portfolios that we are tracking. Portfolio Einstein is …

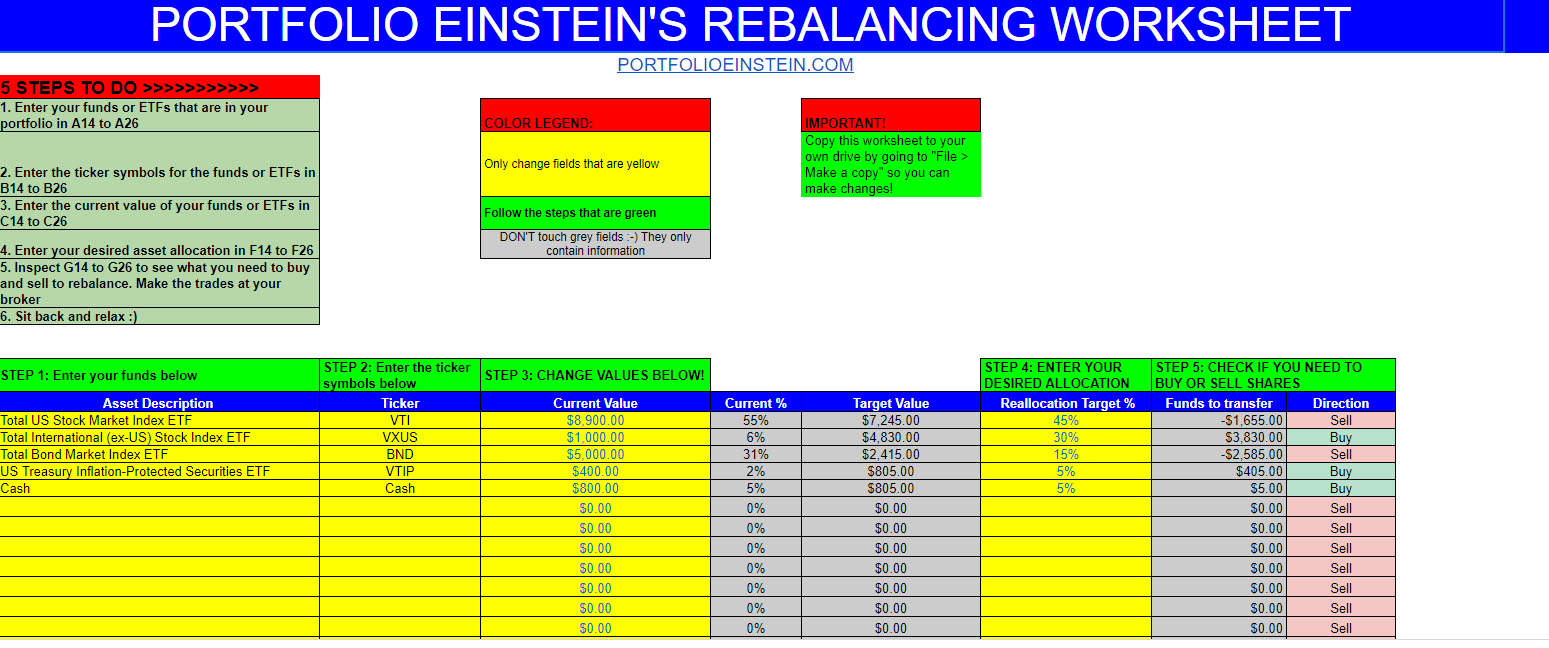

Get a simple, easy-to-use portfolio rebalance tool. It will help maximize your returns and lower your risk. It’s all FREE!

Rebalancing is when you bring you asset allocation back into your desired asset allocation mix.

If you want a 90% stock allocation and 10% bond allocation in your portfolio you may experience that your stock portion of your portfolio increases over time. This is because stocks have historically generated a higher rate of return than bonds and will likely continue to do so in the future.

Over time you may see your stock allocation go from 90% of your portfolio to 95% of your portfolio. Your bond portion of your portfolio will consequently shrink to 5% of your portfolio. The bonds may not have lost any value – it is just that your stocks have increased in value in comparison to your bonds. With your portfolio now consisting of 95% stocks and 5% bonds, the volatility of your portfolio has increased from its initial risk level. This is where rebalancing comes into play If you want to decrease the risk of your portfolio.

Rebalancing helps you because your portfolio will drift out of its initial asset allocation over time. Using a rebalance tool makes sure that your portfolio stays within the desired asset allocation.

The video below explains in a little more detail what rebalancing means.

There are many advantages to rebalancing regularly

The only two disadvantages to rebalancing your portfolio are:

With Portfolio Einstein’s rebalancing tool you can hopefully cut down on the time it takes 🙂

There can be tax consequences when you rebalance especially if you sell an asset class in order to buy another, so have that in mind.

To avoid a possible tax event consider instead buying more of the asset classes that have decreased in value. That way you don’t have to sell any assets but you can still reach your required target allocation.

Consider your total portfolio allocation across accounts. You could hold only stocks in one account and only bonds in another account. You decide what makes sense but seeing all your assets as one investment portfolio could save you transaction fees and taxes. It could also help you with establishing a correct asset location (placing asset classes where it makes the most sense tax-wise).

Google Sheets:Rebalancing Tool

Important! Make sure you make a copy of it to your drive or else you won’t be able to edit it to your own needs!

Here is how you do that:

From within Google sheets:

Select “File > Make a copy” from the upper left corner.

Here’s another video that explains in a little more detail what rebalancing means.

If you have already committed to a portfolio then maybe you need help maintaining the portfolio. In this case you will find our rebalance worksheet useful.

Rebalancing your portfolio lowers your risk and may provide higher returns in the long run. It is completely FREE.

You can find the rebalance worksheet in our article Here Is The Most Easy To Use Portfolio Rebalance Tool.