Portfolio Performance of the Investment Portfolios

This page displays all of the investment portfolios that we are tracking. Portfolio Einstein is …

Understanding what asset classes translate into getting higher returns. If you want to be an above-average investor, you need to get the basics of asset classes.

Fortunately, it is not hard. Let’s give you an overview.

Asset classes are like the pieces of a puzzle. The puzzle is your entire portfolio. Together the puzzles form your portfolio. All portfolios have asset classes. And all portfolios can be broken down into their respective asset classes.

So why are asset classes essential to understand?

It is because some asset classes like value have performed better in the past than other asset classes. That means you should consider adding a portion of the best historical performing asset classes to your portfolio if you want to be an above-average investor.

But what is an asset class? We’ll cover that next.

There are many definitions of asset classes. Here’s one from Investopedia:

“An asset class is a group of securities that exhibits similar characteristics, behaves similarly in the marketplace and is subject to the same laws and regulations.”

The three major asset classes are:

They each behave very differently to each other in the marketplace. For example, bonds typically go up when stocksgo down. There are many more asset class to be considered. See below for a much larger list.

Larry Swedroe of BAM alliance e has an even better one in his educational and fantastic book Your Complete Guide to Factor-Based Investing: The Way Smart Money Invests Today.

Here he lists the requirement for how an asset class must behave to be considered an asset class:

Larry Swedrow talks about factors here, but it can easily be applied to asset classes. The factors versus asset class discussion is a post in itself.

There are at least two ways to define an asset class:

Both are used in the investing world. Here’s how we do it using small-cap as an example.

Defining an asset class in absolute terms: Take all the stocks under a $2 billion market cap and put them in an index. These are now a small-cap blend asset class.

Defining an asset class in relative terms: Take all the stocks and measure their market. Now take the bottom 10% and put them in an index. These are now a small-cap blend asset class.

Both are used but the relative is more prevalent.

For growth and value, the relative is almost always used. Growth and value are defined in relation to each other. They are merged at the hip as Warren Buffet says.

That’s the end of this very short primer on asset classes. A longer and more detailed post is upcoming.

If you want to know much more about asset classes I can recommend 3 books:

You should also check out our recommended reading article, it is 55 Best Investing Books, Boost Your Money and Awesome Brain

Check out the video below for a short introduction to asset classes.

There are a lot of asset classes if you really start looking for them. The important thing to have in mind is that diversifying across many asset class is a good idea and often yields higher returns.

For example, U.S stocks seem to zig when foreign stocks zag so it is a good idea to have both in your portfolio.

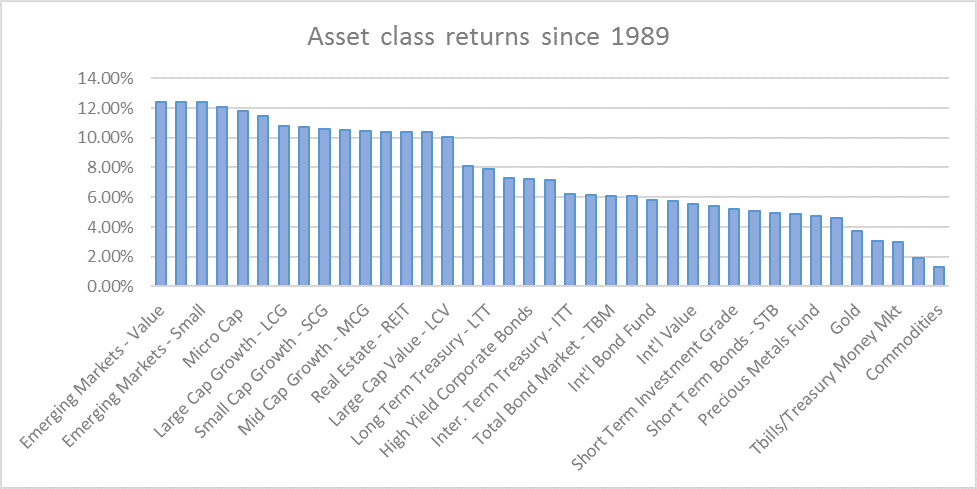

Below is a table of returns along with standard deviation, drawdown, and market correlation. It is sorted by highest returning asset class to lowest.

| Asset class | Returns | STD | Drawdown | Market correlation |

| Emerging Markets Value Stocks | 12.41% | 38.77% | 53.94% | 0.48 |

| Mid-Cap Value Stocks | 12.38% | 18.06% | 39.41% | 0.81 |

| Emerging Markets Stocks | 12.38% | 38.60% | 54.53% | 0.47 |

| Mid-Cap Blend Stocks | 12.05% | 17.89% | 41.82% | 0.90 |

| Micro-Cap Stocks | 11.81% | 23.83% | 42.75% | 0.70 |

| Small-Cap Value Stocks | 11.43% | 18.42% | 36.86% | 0.74 |

| Large-Cap Growth Stocks | 10.80% | 20.50% | 48.30% | 0.96 |

| Small-Cap Blend -Stocks | 10.72% | 19.01% | 36.07% | 0.89 |

| Small-Cap Growth Stocks | 10.60% | 19.46% | 40.00% | 0.90 |

| Emerging Markets Stocks | 10.51% | 32.97% | 52.81% | 0.57 |

| Mid-Cap Growth Stocks | 10.47% | 24.16% | 55.29% | 0.90 |

| Total US Stock Market | 10.42% | 17.58% | 37.07% | 1.00 |

| Real Estate – REITs | 10.38% | 18.16% | 47.41% | 0.48 |

| Large-Cap Blend Stocks | 10.37% | 17.51% | 37.71% | 0.99 |

| Large-Cap Value Stocks | 10.07% | 16.36% | 35.97% | 0.95 |

| International Europe Stocks | 8.08% | 19.53% | 44.73% | 0.86 |

| Long-Term Treasury Bond | 7.90% | 11.44% | 13.03% | -0.21 |

| Total World Stock Market | 7.31% | 17.59% | 41.88% | 0.90 |

| High Yield Corporate Bonds | 7.21% | 10.99% | 21.29% | 0.70 |

| Intermediate-Term Corporate Bond | 7.18% | 6.85% | 6.99% | 0.42 |

| Intermediate-Term Treasury – ITT | 6.19% | 6.27% | 4.33% | -0.20 |

| TIPS | 6.15% | 6.75% | 8.92% | 0.06 |

| Total US Bond Market | 6.08% | 4.82% | 2.66% | 0.12 |

| Long-Term Tax-Exempt Muni Bond | 6.06% | 6.05% | 5.76% | 0.27 |

| International Bond Fund | 5.83% | 4.47% | 4.85% | 0.18 |

| International Small Stocks | 5.78% | 24.85% | 50.37% | 0.61 |

| International Value Stocks | 5.53% | 19.74% | 43.92% | 0.74 |

| Intermediate Tem Tax Exempt Muni Bonds | 5.39% | 4.20% | 2.12% | 0.21 |

| Short-Term Investment Grade Bond | 5.18% | 4.25% | 4.74% | 0.44 |

| Total International Stocks | 5.04% | 19.94% | 44.10% | 0.75 |

| Short-Term Bonds | 4.95% | 3.84% | 0.86% | 0.06 |

| International Developed Stocks | 4.88% | 19.02% | 43.67% | 0.77 |

| Precious Metals Fund | 4.76% | 35.46% | 72.37% | 0.23 |

| Short-Term Treasury Bonds | 4.62% | 3.99% | 0.58% | -0.06 |

| Gold | 3.73% | 14.35% | 36.65% | -0.19 |

| Short-term Tax Exempt Muni Bond | 3.08% | 2.07% | 0.00% | 0.01 |

| Tbills/Treasury Money Market | 3.00% | 2.55% | 0.00% | 0.06 |

| International Pacific Stocks | 1.93% | 22.32% | 50.39% | 0.55 |

| Commodities | 1.32% | 25.45% | 72.86% | 0.17 |

You can find the best-in-class ETF for each asset class in the article What Is The Best ETF And Mutual Fund?

As you can see value, small-cap and emerging markets have performed very well. The ones that have performed the worst are commodities, cash (t-bills), Pacific stocks (due to the Nikkei asset bubble), gold and precious metals. Gold is just barely keeping up with inflation.

Gold has never been a very good investment nor a good speculation. This is because it does not produce anything like companies. It does not provide a steady stream of revenue.

Emerging markets may have had the highest return but they also have the highest risk in the form of standard deviation and large drawdowns.

A special mention to the all-time worst performing asset class:Commodities. Commodities has the distinct displeasure of having the worst returns and the most severe drawdown since 1987. It also takes the 2nd place as the riskiest asset as measured by standard deviation.

Avoid commodities.

When you visit the portfolios on portfolioeinstein.com you see that the best performing portfolios are the ones with more than one asset class.

This is because when one asset class zigs the other zags. This helps to stabilize your portfolio. It also helps your returns. This is due to the rebalancing effect. When you rebalance you buy more of the asset class that has gone down in value and sell more of the asset class that has gone up in price. YIn practice you buy low and sell high. If you several asset classes in your portfolio you will have more opportunities to rebalance. This is evident from the Morningstar Target date index which performed particularly well. See What Is The Best Target Date Fund?

You can find out more about rebalancing in our article that also sports a free tool.Here Is The Most Easy To Use Portfolio Rebalance Tool

Before you go all in in the best performing asset class you should be aware of a few things:

The best course of action is to pick a portfolio with a light to heavy overweight of the best performing asset classes. You can find all the portfolios here.

You can see which asset classes are needed to construct the portfolio along with their ticker symbols for the corresponding ETF. You can also find our best-in-class ETFs here.

This has been a very short introduction to asset classes. The takeaway is that you need more than one asset class in your portfolio so that you can lower your risk and increase your returns. Don’t worry about the returns of the asset classes, however, worry about the portfolio you want to go with.

You should select a portfolio that has a high probability of reaching your financial goals while being aware of the risks.

We’re planning a follow up where we go into details about which asset classes will do best under certain conditions.

Sign up for our newsletter to be notified when that happens.